Revenue Deficit Grant

Context:

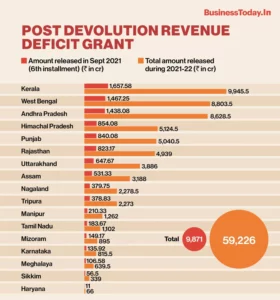

- The Department of Expenditure, Ministry of Finance has on Monday released the 3rd monthly instalment of Post Devolution Revenue Deficit (PDRD) Grant of Rs.7,183.42 crore to 14 States.

The grant has been released as per the recommendations of the Fifteenth Finance Commission.

What is Post Devolution Revenue Deficit (PDRD) Grant?

- The Post Devolution Revenue Deficit grants are released to the states as per the recommendations of the successive Finance Commissions to meet the gap in Revenue Accounts of the States post-devolution

- The Post Devolution Revenue Deficit grants are provided to the states under Article 275 of the Constitution.

Article 275 empowers the Parliamnet to make laws to provide financial assistance to States in the form of grants-in-aid charged to the revenue of India.

How is the devolution of tax done in India?

- The devolution of taxes by the Union Government is based on the recommendations made by the finance commission, currently the fifteenth finance commission.

- The two main functions of the Finance Commission is to determine the share of the net proceeds of Taxes between the centre and the states and relative share of each state among them.

- Under the Fifteenth Finance Commission the share of the states under the Union taxes is 41% for the period from 2021 – 2026.

- This is less than the previous recommendation by the Fourteenth Finance Commission which was 42%, the remaining 1% exclusively kept for the newly formed Union Territory J&K and Ladakh.

What are the criterias for devolution?

While determining the share of states the finance commission keeps in mind certain criterias including:

a. Income Distance – 45%

b. Area – 15%

c. Population – 15%

d. Demographic Performance – 12.5%

e. Forest & Ecology- 10%

f. Tax & Fiscal Efforts – 2.5%

Click here for more updates on current affairs

Source The Hindu