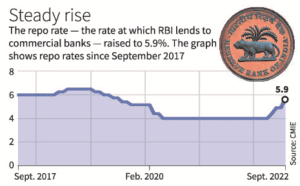

Reserve Bank raises rates by 50 bps, brings down growth outlook to 7%

#GS-03 Economy, Monetary Policy

For Prelims

About Monetary Policy Committee.

- The Monetary Policy Committee (MPC) is created to set the policy interest rates as a part of its monetary policy.

- It is headed by the Governor of the Reserve Bank of India (RBI) and has another 5 members out of whom 3 are nominated by the government and the other three will be from RBI.

- No government official will be nominated to the MPC.

- The government nominees to the MPC will be chosen by a Search-cum-Selection Committee under Cabinet Secretary and consisting of RBI Governor and Economic Affairs Secretary and three experts in the field of economics or banking or finance or monetary policy.

- Members of the MPC are appointed for a period of four years and shall not be eligible for reappointment.

- Decisions are taken by majority vote with each member having a vote.

- It is set up based on the recommendation of the Urjit Patel Committee.

- The Monetary Policy Committee (MPC) was set up under Section 45ZB of the RBI Act of 1934 by the Union government.

- The Monetary Policy Committee (MPC) is required to meet at least four times a year.

- The quorum required for the meeting of the MPC is four members.

- Each member of the MPC has one vote, and in the event of an equality of votes, the Governor has a second or casting vote.

- Once every six months, the Reserve Bank is required to publish a document called the Monetary Policy Report.

About Monetary Policy:

- Monetary policy refers to the policy of the central bank which uses monetary instruments under its control to achieve the goals specified in the Act.

- The primary objective of the RBI’s monetary policy is to maintain price stability while keeping in mind the objective of growth.

Instruments of Monetary Policy Committee

Quantitative instruments:

- Repo rate, Reverse Repo rate, Marginal Standing Facility (MSF), Bank Rate, Cash Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR), Open Market Operations (OMOs)

Qualitative Instruments:

- Direct action, change in the margin money, and moral suasion.