Front-Running

Context:

• Axis Asset Management Company, which manages assets worth Rs 259,818 crore, suspended two fund managers recently for various irregularities, including front-running the AMC’s transactions on their personal accounts.

What is Front Running?

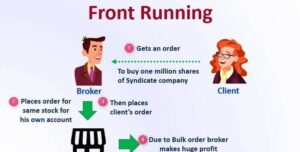

• In India, front-running is defined as the purchase of a stock based on advance non-public information about a significant transaction that will affect the price of the stock.

• Before executing the MFs’ order, some fund managers buy the same shares in their personal accounts.

• When mutual funds buy in large volumes, the stock price is predicted to rise.

• Because a person who engages in front running expects securities price fluctuations based on non-public information, Sebi has classified it as a type of market manipulation and insider trading. Sbi has already investigated and sanctioned a number of fund companies and fund managers for front-running.

• According to market sources, front-running has been very common in mutual fund houses and foreign portfolio investors.

What is a mutual fund?

• Mutual fund is a mechanism for pooling the resources by issuing units to the investors and investing funds in securities in accordance with objectives as disclosed in offer document.

• Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced.

• A mutual fund assists in the accumulation of funds for investment reasons, which stimulates the economy’s industries.

• It invests the public’s tiny savings and channelizes them into the economy.

• The Securities and Exchange Board of India is a statutory agency that regulates mutual funds and India’s capital market. It was created in 1992.

Source: THE HINDU.

For more update, click here to join our telegram channel