EPFO pension scheme

#GS-02 Social Security

For Prelims:

About EPFO:

- Employees’ Provident Fund Organisation (EPFO) was established by an act of Parliament of India, to provide social security to workers working in India.

- It came into effect under Employee Provident Fund and Miscellaneous Provision Act, 1952 and is applicable throughout the country.

- EPFO comes under the control of the Ministry of Labour and Employment, Government of India.

- It is one of the World’s largest Social Security Organisations in terms of clientele and the volume of financial transactions undertaken.

Schemes of EPFO:

EPFO Scheme 1952

Salient features of EPFO schemes

- Accumulation plus interest upon retirement and death

- Partial withdrawals allowed for education, marriage, illness and house construction

- Housing scheme for EPFO members to achieve the Prime Minister’s vision of Housing for all by 2022.

Pension Scheme 1995 (EPS)

Salient features of the Pension Scheme

- The monthly benefit for superannuation/benefit, disability, survivor, widow(er) and children

- Minimum pension of disablement

- Past service benefit to participants of the erstwhile Family Pension Scheme, 1971.

Insurance Scheme 1976 (EDLI)

Salient features of the scheme

- The benefit provided in case of the death of an employee who was a member of the scheme at the time of death.

- Benefit amount 20 times the wages, maximum benefit of 6 Lakh.

For Mains:

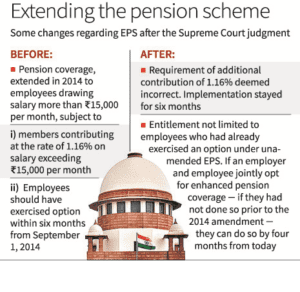

Supreme Court extended the provisions of EPFO schemes. The expanded provisions are: